Preparing For Postacquisition Success

By Bruce Milne, CEO, Corum Group

Your integration and employee retention plans are easy steps to neglect in the M&A process, but they are crucial to the overall success of selling your software company.

In the midst of selling a software company, it is easy to neglect the final phase of the M&A process — namely, the integration of the two companies after the deal is closed. According to an Ernst & Young study, nearly 53 percent of mergers fail to meet the buyer’s or seller’s expectations, and integration is the leading factor.

In the midst of selling a software company, it is easy to neglect the final phase of the M&A process — namely, the integration of the two companies after the deal is closed. According to an Ernst & Young study, nearly 53 percent of mergers fail to meet the buyer’s or seller’s expectations, and integration is the leading factor.

As a founder or CEO, you don’t want to be seen as someone who did a deal to benefit yourself, while leaving your customers or employees hanging out to dry. Beyond that, if deal has earnout provisions, with some percentage of the total sale price contingent on the performance of the company going forward, all shareholders have a vested interest in ensuring a smooth and successful integration process.

The good news is that sellers have a significant opportunity to influence the ultimate outcome of integration during the M&A process itself. By anticipating problems, understanding the options, and preparing properly, you can help ensure the deal works for everyone involved.

To begin with, be sure you and the acquirer are on the same page when it comes to the expected level of integration, whether limited, partial, or full integration.

- Full integrations, where the entire company and all its business units are absorbed, are generally less common, particularly at the outset.

- In a limited integration, some aspects of the companies will be consolidated, generally key corporate functions like treasury management, legal, and other things that are not needed onsite, while leaving the acquired company more or less freestanding.

- In a partial acquisition, more departments will be merged together, possibly combining the sales organizations or some of the development or support activities.

During the integration period, many people will be performing two jobs, so everybody will be stressed. There will be lots of uncertainty about people’s positions, who they report to, etc. Thus, it is critical that there be open communication and feedback. Set realistic expectations, as full integration often takes time.

ESTABLISH AN INTEGRATION PLAN WITH THE BUYER

To mitigate these issues, you will need to develop an integration plan with the buyer. Put together a multidisciplinary team with members from both companies and across all departments. You can’t just have the guy who runs sales trying to run the entire initiative. Create a team balanced with HR, legal, development, ops, sales, marketing, and other key departments. If possible, put in place a full-time executive officer as integration manager to guide the process. Have the team and manager set key events, create milestones, and develop a 90-day plan that everyone can focus on.

Ninety days is short enough initially that everyone can know and understand what the plan is, what the objective is, and how close you are to achieving it. It’s a short-enough time frame that it can motivate people to get on the bandwagon. Then monitor that progress and report back what is happening, making sure people know and understand what is happening and where they stand.

With an integration manager and an integration team in place, they should develop the plan and execute it, charting how the companies will come together across all departments. Who are all the players and what needs to be done? The goal of the plan is to mitigate risks, keep key employees, protect the intellectual property, and engineer the short-term wins. Make everybody feel part of the team and want to be part of the deal going forward.

FOCUS ON KEY EMPLOYEES & TRANSPARENCY

You have a variety of audiences here. Not just shareholders, but also employees, customers, vendors, partners, and of course the investment banking community needs to know and understand what this deal is and why it’s good for all of these participants. When things get bumpy, you need to go back and tell people, “There’s a reason we did this; let’s refocus on that plan and make this work.”

You need to establish an operations model. First and foremost is the organizational chart: Who works for whom. In many situations, you will have duplicate roles and responsibilities. There’s only one VP of engineering, so you need to figure out who will be that head and how to make sure the other person knows they have an important role moving forward. Fortunately, in most cases, much larger organizations take over much smaller organizations, providing significant opportunity for the acquired company’s employees to advance within the buyer’s ranks.

Throughout the process, identify and focus on the key employees. They are the glue that will ultimately bond the two companies together. There will be a half-dozen or a dozen, depending on the size of the organization, key people that the rest of the employees will look up to and respect. If these key people are on board, the rest of them will follow.

There are many ways to do this:

- For some, you will want to have one-on-one conversations.

- You can also institute regular small team Q&A meetings to give people an update and make sure they know they’re part of the team.

- For larger groups, you can do “town hall” meetings.

- Provide welcome packages to make sure people know and understand the new organization and what it offers.

- Another good option is a peer-level “buddy system,” linking employees laterally to someone in the same position within the new organization. When an employee has a problem or a question, they don’t have to go up some ladder to learn the context, but can speak with a peer within the acquiring organization and get immediate feedback.

An unpleasant item that you may need to deal with is layoffs. These are generally uncommon in software acquisitions, but if you find yourself in that situation, it is best to do it immediately — ideally, the same day as the merger. This gives those who remain the confidence that they are not about to be laid off.

An announcement of, “We were forced to let go of these people for this reason, but we foresee no future layoffs and you can rest assured that we have employment packages for each and every one of you in the new organization moving forward” will turn an unfortunate situation into a positive statement for those staying with the company.

DEVELOP AN EMPLOYEE RETENTION PLAN

The most critical piece of the integration is the employee retention plan. Any transition as significant as an acquisition will naturally make employees consider their options, even in the best of circumstances. In the worst circumstances, you can find a significant amount of money held hostage by a single disgruntled key employee who didn’t receive compensation or incentives commensurate with his/her value to the company.

Ensuring the success of your company going forward, as well as the goodwill of employees and their families, requires investment to confirm they are sharing in the gains of the company.

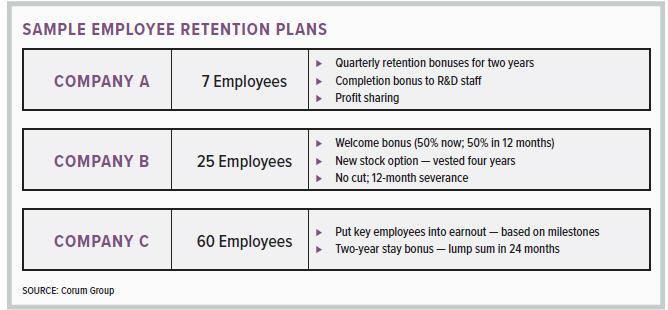

Retention plans will vary from company to company based on the specifics of the situation, but there is a common set of tools that companies can make use of in various combinations. This includes some combination of welcome bonuses, retention bonuses, completion bonuses, profit sharing, stock options, no-cut provisions, and even sharing a percentage of the earnout itself amongst the employees.

The value of retention bonuses is evident, as employees are directly incentivized to stay through the transition period. These can also be given as welcome bonuses, where half is provided up front and the other half after 12 months. Stock options that vest after a period of time can have the same impact.

When there are significant technical projects in process at the time of the acquisition, or where the technical integration itself is likely to be a significant task, a completion bonus offered to the team working on that project — R&D, development, etc. — can be a more directed incentive toward accomplishing the goals necessary for a successful integration. A profit-sharing plan can have a similar impact on the sales and marketing side.

The broadest way to engage your employees is through adding them to the earnout program. In general it is a good idea to do so if there is earnout as a part of the transaction. If you lose all of your people, your chances of achieving the earnout shrink dramatically. We have seen deals where as much as 30 percent of the earnout was shared with employees. That can seem like a significant amount, but if the alternative is a possibility of achieving no earnout whatsoever, it’s a good deal.

Whatever the specifics of your integration plan, from organizational structure to retention, strive to have as many specifics as possible negotiated before closing. While there is significant, legitimate pressure during a deal to “just get it closed,” it is worth spending time to be sure that your employees and other stakeholders will be taken care of after the deal is closed. Many of these items can be negotiated and outlined in the final purchase agreement.

As with all aspects of the M&A process, this negotiation will go much more smoothly if you run a careful, global process with multiple buyers brought to the table. Without the leverage of another party or two waiting in the wings, it can be difficult to persuade an acquirer to focus on integration at this phase. Instead, many would rather wait until the deal is closed and they can make decisions based on their own priorities, which may or may not line up with yours. In this case as in all others during the process, it’s likely the most important transaction of your life — do it right.

BRUCE MILNE has overseen more technology M&A transactions than anyone in the world as CEO of the Corum Group, netting sellers over $7 billion in personal wealth. Prior to Corum, he founded or owned four software/IT/internet related fi rms. As a recognized software expert, he has served on numerous advisory boards including at Microsoft, IBM, and Apple, and has been a keynote speaker in 20+ countries.