Sales Tax For SaaS: A 2019 Update

By Steve Sehy and Chris Livingston

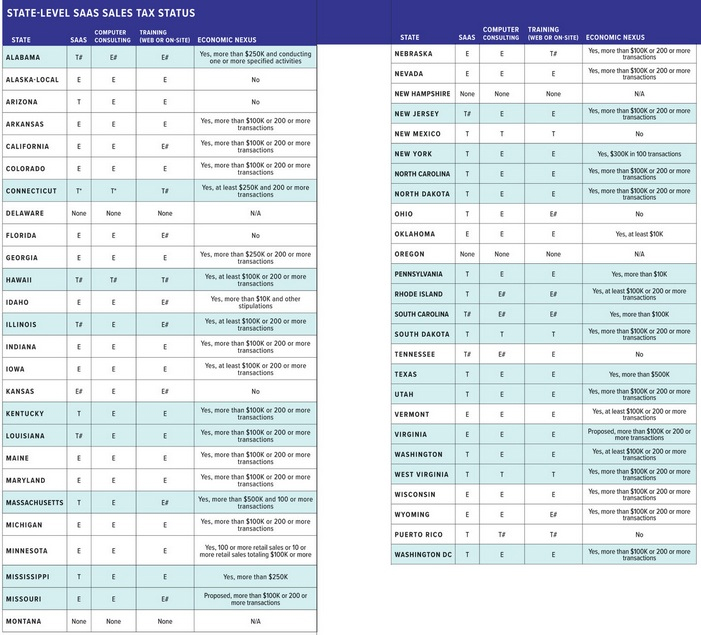

A state-by-state breakdown of the ever-changing SaaS sales tax status

The states have been rapidly changing the sales tax environment for internet businesses, including Software-as-a-Service (SaaS). This includes changing the definitions and taxability of SaaS as well as the requirements for determining in which states a company needs to collect sales tax. Since none of this contributes to company revenue or income, the best-case scenario is breakeven, and the worst-case scenario includes paying sales tax to a state (10 percent or more of revenue) when you didn’t collect it, as well as penalties. While larger companies may have a team working on this, small to midsize SaaS companies are struggling to deal with this issue.

WARNING: If you sell SaaS to customers in multiple states, it is very likely that you now need to be charging sales tax.

CURRENT STATUS — TAXABILITY BY STATE

We have assembled a table indicating the current status of taxability in each state (see pages 14-15). Note: The definition of SaaS is different from state to state. You will have to research to confirm that your business falls within the definition that we used. Some states still identify SaaS as Application Service Providers (ASPs). In a SaaS/ASP model of delivery, software applications are delivered as services, rather than products, as in traditional licensing models. Application Service Providers host and maintain software for the end user, who then accesses software over the internet.

CURRENT STATUS — NEXUS

Nexus is the term indicating whether you need to collect and remit sales tax to a state. It means that you have sufficient contact with a state such that you fall within its tax laws. The general rule is that if you have an employee or a property in a state, you have nexus with that state.

Note: if you have a remote sales force, one employee in a state is enough to trigger nexus.

Economic nexus is when the only connection between the company and the state is that your product is being sold in the state. So a state with economic nexus requires you to collect sales tax even if you do not have a physical presence in the state. After the South Dakota v. Wayfair Supreme Court ruling, more states have enacted remote seller laws that create economic nexus by just selling in the state. However, many of the states have minimum sales amounts and/or minimum transactions in the state before these rules apply. Also, instead of collecting tax, some of these laws require you to send your customers and the state a report indicating that sales tax was not charged and therefore the customer must pay the use tax. The table on pages 14-15 indicates which states have economic nexus and their thresholds.

COURT CASES AND PROPOSED FEDERAL LEGISLATION

- Supreme Court Cases — In June 2018, the U.S. Supreme Court issued its decision in South Dakota v. Wayfair. The court overturned the requirement from its 1992 ruling in Quill Corp. v. North Dakota, which held that sellers must have a physical presence in a state before they can be required to collect the sales tax. This ruling effectively allows states to collect sales tax on taxable goods sold in the state, regardless of physical nexus, if the economic thresholds are met.

While sales tax is currently governed at the state level, several federal bills have been introduced in Congress over the past few years that could overhaul the U.S. sales tax system.

- Online Sales Simplicity and Small Business Relief Act of 2018 — In September 2018, Wisconsin Congressman Jim Sensenbrenner introduced a bill to reduce the complexity of sales tax and provide relief to small businesses worried about online sales tax obligations in the wake of the Supreme Court case overturning Quill. Among the provisions is a $10 million exemption for small-business sellers until the states simplify collection. It would also protect sellers from states that might want to collect sales tax retroactively.

- The Marketplace Fairness Act (MFA) — This bill got the most traction, passing in the Senate but expiring before further action. In simple terms, it would have required all sellers who gross more than $1 million in remote sales per year to collect sales tax from buyers in states that meet certain requirements.

- The Remote Transaction Parity Act (RTPA) — This bill is similar to the Marketplace Fairness Act but would have gradually, over a period of four years, required all remote sellers to collect sales tax from buyers, no matter their state.

- The No Regulation Without Representation Act — Unlike the other laws, this law would have prohibited all legislation requiring remote sellers to collect sales tax. Instead, it would have codified the precedent that a seller must have physical presence in a state to be required to collect sales tax.

- The Sales Tax Simplification Act (STSA) — In this law, states that elected to participate in a “clearinghouse” and otherwise take steps to make sales tax collection and filing simple for remote sellers could require remote sellers to charge sales tax to in-state buyers.

MONITORING CHANGE

To help you follow sales tax changes in the future, here are some useful links:

- State-by-state reviews of SaaS taxability status:

- www.vertexinc.com/resources/state-sales-tax-changes/state-guides

- www.vertexinc.com/resources/state-sales-tax-changes/faqs

- www.vertexinc.com/resources/insights/supreme-court-decision-webcast

- A report of sales tax changes, updated by Vertex every six months:

- www.vertexinc.com/news

USING AUTOMATION

There are now automated tools to assist you in calculating the sales tax by customer location. In general, these tools allow you to assign a Tax Code for each of your products, and this code is used to pull up the appropriate rate in states that you have activated. After the tax is calculated, the data is used to create and file the state sales tax reports. Some of these tools tie into your current billing system (e.g., QuickBooks). Others provide an API that can be used to integrate into your own checkout or billing systems.

NEXT STEPS TO TAKE

We have worked to simplify the information in this article to make it readable. There is room for interpretation and rapid change is happening in this area.

- If you are not collecting sales tax, review the following table and start a project to start collecting, including verifying nexus, registering in the state, and getting your billing or website systems to start collecting.

- If you are already collecting and remitting tax in some states, review the list and your nexus to determine if you need to add more states.

- Review the states in the table that are highlighted. These are the states where SaaS is taxable and also now have economic nexus. These are states where you may need to start collecting sales tax immediately.

- If you haven’t paid sales tax in a state (and you should have), you can submit a Voluntary Disclosure to the state to resolve back tax issues. Generally, this will reduce your penalties and the look back period. If you find that you have this issue, start the process immediately! Your company is incurring a cost that can be moved to your customers once this process is complete.

- If you don’t have a system in place, talk to a tax person specializing in state and local tax (SALT).

QUESTIONS TO DISCUSS WITH A SALT SPECIALIST:

You will want to have a 12-month revenue report by state and payroll register by state to facilitate this discussion.

- Where does my company have nexus?

- Where does my company have economic nexus based on where we sell and the thresholds?

- In those states where my company has nexus, where does my product offering fit in the definitions of SaaS for each state?

- Where should I get the tax rates based on the buyer’s address?

- Should I have already been collecting sales tax in certain states? How much should I have collected?

As the states continue to look for revenue, these rules will continue to change. Be sure to find a way to keep up to date.

TABLE DATA LEGEND

Data accurate as of January 3, 2019

T = Taxable at the standard rate

T* = Taxable at a nonstandard rate

E = Exempt or nontaxable

None = No sales tax in the state

T#, E# = Generally taxable or exempt, but final tax status may vary based on specific definitions or conditions. This could be due to regulations regarding where the host server is located in relation to the customer or whether the customer takes control of the server.

SAAS COLUMN

Defined as providing access to an Application Service Provider server of canned software delivered electronically over the web.

COMPUTER CONSULTING COLUMN

Defined as fees for setting up a new computer system.

SOFTWARE TRAINING COLUMN

Defined as separately stated charges for training sessions on the use of the software.

ECONOMIC NEXUS COLUMN

NO, PROPOSED, OR YES with the annual thresholds.

STEVE SEHY provides ongoing CFO services to multiple SaaS companies that are planning to raise capital. Prior to this position, he did software development/ product management and was a CPA auditor for RSM. You can find him on LinkedIn or at Steve@CaaSforSaaS.com.

CHRIS LIVINGSTON works with companies of all sizes, automating end-to-end sales tax processes from calculation and exemption certificates to filing. You can find him on LinkedIn or @CLivingston96.