The Shift To A Contactless World

By Mihir Korke, Clover Network

As the name suggests, contactless payments remove physical contact from the checkout experience. Whereas most in-person transactions rely on PINs, signatures, or the exchange of cash, contactless payments allow customers and merchants to interact without direct contact most times – even when they’re face to face.

Contactless payments were already on the rise before the pandemic, and they will likely continue to grow in popularity for in-person transactions after the pandemic subsides.

This article explores why this shift is happening and how contactless payments are helping to improve the shopping experience for businesses and consumers alike.

But first, a quick overview of what contactless payments are and how they work.

What Are Contactless Payments?

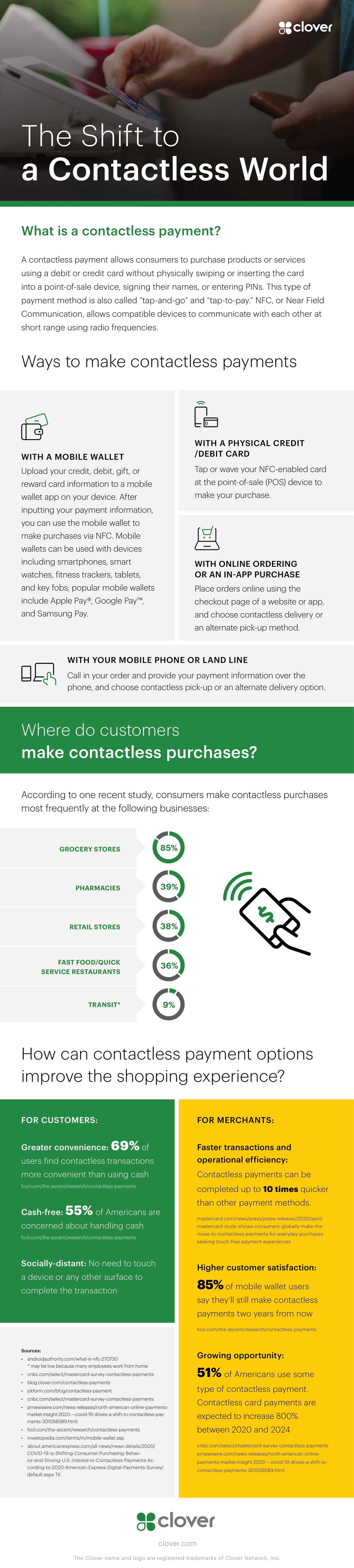

Although contactless payments come in many forms, the most common involve transactions that rely on near field communication (NFC) – a wireless short-wave technology similar to Bluetooth.

For in-person transactions:

- The customer must have an NFC-enabled debit or credit card. Alternatively, he or she can use a mobile wallet stored on his or her smartphone or wearable device. In both cases, the credit card details are already uploaded and encrypted in the mobile wallet for future use.

- The merchant must have an NFC-enabled point-of-sale (POS) reader capable of communicating with the customer’s mobile device or contactless card. Most modern POS machines come with built-in NFC capabilities. However, it’s also possible to take existing smartphones or tablets and convert them into portable NFC-ready terminals by pairing them with a portable contactless payment reader – for in-store sales and off-site transactions at trade shows or other events.

To initiate a transaction, the buyer simply waves his or her credit card or mobile device across the POS reader to establish a wireless connection. The payment goes through without the customer having to sign any receipts or enter a PIN most times.

It’s worth noting that eCommerce and in-app purchases can also be considered contactless payments since they, too, eliminate the need for customers and merchants to come into direct physical contact. The same is true for phone- or mail-based ordering.

Why Is The World Shifting To Contactless Payments?

There are several reasons why the technology – in all its forms – is gaining momentum in the business world, including:

- Security: Contactless payments help offer better fraud protection, particularly when using mobile wallets. This is because a customer must unlock his or her smartphone before trying to wirelessly connect to a POS reader.

- Speed: Contactless payments are up to 10 times faster than those made with traditional magstripe plastic, check, or cash.1 This means more sales per hour for sellers, and much shorter lines for customers.

- Convenience: Shoppers are carrying less cash than ever before, yet almost everyone has a smartphone. This offers the potential to shop at any brick-and-mortar store that accepts contactless payments.

However, one of the biggest drivers behind the current contactless payments boom is safety. With everyone so concerned about germ transmission, customers and merchants around the world are incentivized to keep physical contact to a minimum.

This trend is most noticeable among businesses with consumables – such as supermarkets, where 85% of U.S. customers report using contactless payments to buy their groceries.2 That said, experts predict the technology to grow 800% from the start of the pandemic through 2024. 3 Contactless payments could likely reach similar levels of penetration across all industries over the next decade.

It’s still possible to generate sales and grow your business without offering contactless payments. Given their ability to make the shopping experience faster, easier, and safer – businesses that want to thrive should consider expanding their payment environment to include this increasingly popular option.

For a more detailed exploration of how contactless payments are helping to revolutionize business, retail, and finance, be sure to review the accompanying resource.

Author The Author

Mihir Korke is Head of Acquisition at Clover Network, a leader in small business credit card processing and POS systems. Clover specializes in restaurant, retail, and personal and professional service payment solutions. With desktop and mobile POS systems, contactless payments, solutions for curbside pickup and online ordering, loyalty, and rewards, Clover has multiple solutions to meet your business’s needs.

- “Mastercard Study Shows Consumers Globally Make the Move to Contactless Payments for Everyday Purchases, Seeking Touch-Free Payment Experiences,” Mastercard, 29 April 2020

- “More than half of Americans now use contactless payments, according to Mastercard poll,” CNBC, 18 November 2020

- “North American Online Payments Insight 2020, COVID-19 Drives a Shift to Contactless Payments,” PR Newswire, 11 May 2020

https://blog.clover.com/wp-content/uploads/2021/02/shift-to-contactless-world.pdf