Using Recurring Revenue To Identify Customer Service Opportunities And Risks

By Tom Sweeny, founder and principal of ServiceXRG

Examining the specific underlying elements that contribute to the calculation of Net Recurring Revenue provides the necessary insights to identify the root causes of churn, attrition, and contraction.

I am often asked what the top metrics are for measuring the effectiveness of a service organization. The answer depends on what you want to know about the performance and impact of Services. There are metrics that every service organization should track including the costs to deliver services (cost per case), the timeliness and efficiency of service delivery (response time, first contact resolution, time to resolution) and the impact of services as measured by customer satisfaction and net promoter. The financial dimensions of service are important too (revenue, margin, attach and renewal rate). High-level performance indicators and deep data analytics can reveal many insights about your service business and the overall health of customer relationships.

If you don’t have the time to review a lot of data, there is one metric that can provide a great deal of insight into the health of customer relationships and indicate the performance of services and other customer-facing departments. The one indicator that rules them all is Net Recurring Revenue. When measured on a monthly, quarterly, or annual basis you can learn a lot.

Net Recurring Revenue

Recurring revenue is, or should be, predictable and expected income earned from ongoing relationships such as subscriptions and service contracts. Measuring Net Recurring Revenue provides an indication of the performance and impact of service offers, products, programs, and customer-focused policies and practices.

Net Recurring Revenue measures the impact of additions and losses to recurring revenue over a specified period, and the Net Recurring Revenue Rate indicates if the overall value of customer relationships is expanding or contracting.

Inputs

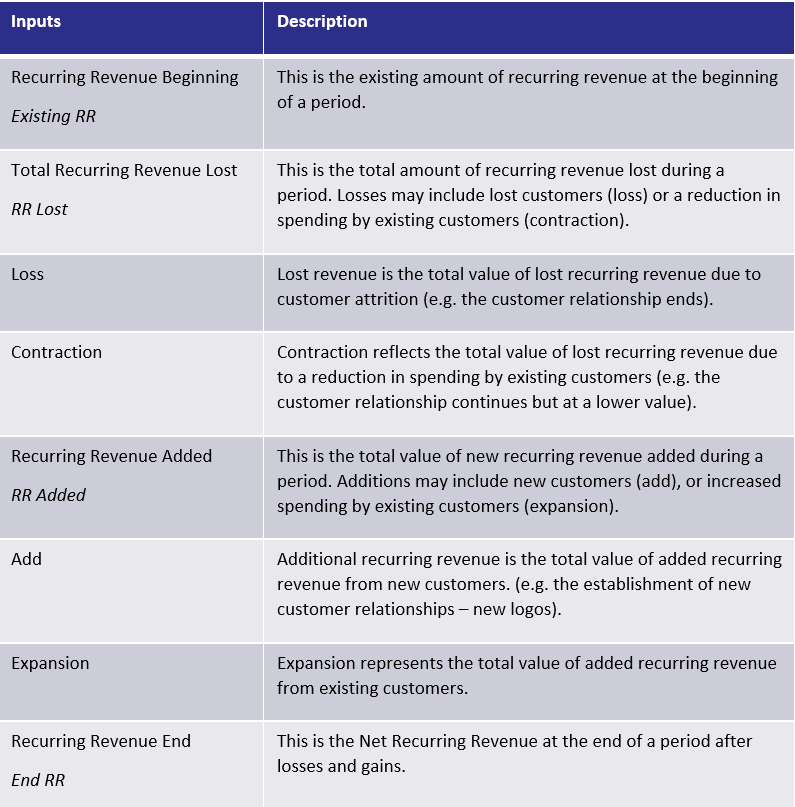

To calculate the Net Recurring Revenue Rate, you need to know how much recurring revenue is added and lost within a period. While you can calculate Net Recurring Revenue Rate by knowing the aggregate recurring revenue you add and lose within a period, it is ideal to have as much granularity as possible.

The type and magnitude of changes to Net Recurring Revenue Rate can provide important insights into the reasons for changes to the value of customer relationships. The following table provides inputs necessary to calculate the Net Recurring Revenue Rate.

Calculating Net Recurring Revenue

Net Recurring Revenue is a time-based measurement. Choose a period such as a month, quarter, or year. The shorter the period the more likely you are to find variations from period to period due to time-based market factors and customer behaviors.

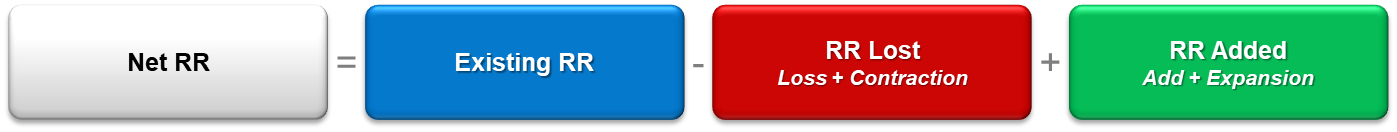

The formula for Net Recurring Revenue is straightforward. Start with your existing recurring revenue at the start of a period, subtract recurring revenue lost during that period, and add recurring revenue added. See the formula in figure A.

Figure A

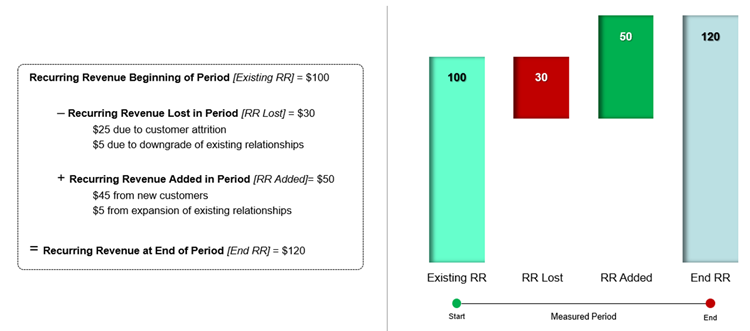

Using this formula, we can calculate Net Recurring Revenue using the sample figures in figure B. The result of adding new revenue and reducing lost revenue based on these sample values indicate that the Net Recurring Revenue at the end of the measured period is $120, a net increase of 20%.

Figure B

The Meaning of Net Recurring Revenue

Measuring Net Recurring Revenue yields obvious findings including a clear indication about the extent to which recurring revenue is growing or declining. The more important insights from this metric come by examining the reasons for growth or contraction of Recurring Revenue. Consider the following when examine Net Recurring Revenue:

- What is the trend in Net Recurring Revenue – growth or contraction?

- What is the rate of rate of change in growth / contraction?

- What are the primary reasons for loss of recurring revenue?

- What are the primary factors that contribute to revenue gains?

Net Recurring Revenue Trends

It is important to understand the trends in in recurring revenue growth or decline. Of course, revenue growth is preferred, but decline may also occur. Establish a reasonable representation of recurring revenue performance over a period that is long enough to accurately reflect typical customer buying behaviors and normal sales, adoption, and renewal cycles.

Measurement Period

The first consideration is the examined measurement period. Short duration measurements (e.g. monthly) may reflect short-term factors that may be normalized over time. Measurement over longer periods can provide a more accurate reflection of the actual trajectory of recurring revenue performance.

The Sources of Growth

If Net Recurring Revenue is growing it is important to understand why so that growth can be sustained or accelerated. Growth will come by establishing new customer relationships or from increased spending by existing customers. Differentiation and understanding the sources of growth is important.

New Logos

Is growth coming from entirely new customer relationships? If so, chances are that your product/services are in demand, customers are aware of your products, want access to your capabilities and that your reputation is positive. This suggests sales and marketing efforts are working.

Consider if growth can be accelerated. Are your reaching your maximum addressable market or are there even more customers that you can win over? Ask new customers why they choose your product over other possible alternatives. Is it your reputation, your capabilities, price, other factors, or a combination of all the above? You may be able to sharpen market messaging and enhance the overall value proposition to attract new customers.

Acquiring new customers is great, just make certain that you can nurture and sustain the new relationships.

Expanding Customer Relationship Value

How much revenue growth is coming from existing customers through increased spending? Perhaps one of the strongest indicators of customer satisfaction is their willingness to expand their relationship with you. Expansion may be a result of the utility of your product and services and may indicate that your products are easy to use and/or that the success services you have in place effectively help customers adopt and apply products.

Growth attributed to existing customers is something that every company must understand. Engage your customers that increase their spending with you to understand why. Determine how you can accelerate expansion of customer relationship value.

Low or No Expansion of Existing Customer Relationship Value

If you determine that very little growth is coming from existing customers, ask yourself why? Are customers still trying to achieve value with what they already have? If so, you may need to provide more assistance to help customers with onboarding, adoption training, and success planning. It is also possible that growth may be inhibited by lack of value-added offers and extensions. Examine your product and service portfolio. o you offer what your customers need? Are there additional services that your customers are willing to buy from you? If so, it is time to expand your portfolio of offerings.

Reasons For Loss

All the gains from new customer relationships and revenue expansion within your existing customer base can be quickly erased if you do not retain the customers you have. Even if you have a positive Net Recurring Revenue Rate, losses are eroding your full revenue growth potential.

Customer Loss versus Revenue Loss

Recurring revenue loss may occur because existing customers choose to spend less with you from period to period (e.g. downgrade their subscription level or number of licenses). In these situations, you retain the customer relationship, yet you get less revenue from an existing customer. Understanding why customers choose to reduce their spend level is important and should be examined so that underlying issues can be mitigated.

Most recurring revenue loses are likely the result of losing a customer relationship. Customer attrition is inevitable. Companies go out of business and/or sometimes legitimately no longer need to use your product. Many of the reasons for customer churn can be mitigated when identified and understood. If customers cannot derive value form your products, understand why. Perhaps it is simply a matter of not being able to achieve the outcomes they expect – if so, consider better onboarding, adoption, and training programs. Perhaps the products lack the features a customer needs, or product capabilities are limited, or performance is unreliable. These are issues that need to be brought to the attention of the product development team. Customer attrition may also result from poor sales, service, and renewal practices.

It is imperative to understand how much revenue you are losing and what percent of that can be retained if changes are made to products, programs, and customer-facing practices and policies.

Retain, Expand and Grow

Net Recurring Revenue is a comprehensive indicator that reveals the extent to which you are retaining, expanding, and growing customer relationship value. Examining the specific underlying elements that contribute to the calculation of Net Recurring Revenue provides the necessary insights to identify the root causes of churn, attrition and contraction. In addition, examining the reasons for revenue growth presents opportunities to embrace practices that encourage expansion of relationship value.

Retention and Recurring Revenue Model

This article is based on ServiceXRG’s Retention and Recurring Revenue Model which helps companies examine the financial health of customer relationships to identify the factors that affect recurring revenue retention and growth. For more information contact Tom at tsweeny@servicexrg.com.

---

TOM SWEENY is the founder and principal of ServiceXRG. He leads research initiatives and publishes extensively about service industry trends and best practices. He helps companies develop and execute service strategies to strengthen customer relationships and optimize financial performance.

TOM SWEENY is the founder and principal of ServiceXRG. He leads research initiatives and publishes extensively about service industry trends and best practices. He helps companies develop and execute service strategies to strengthen customer relationships and optimize financial performance.